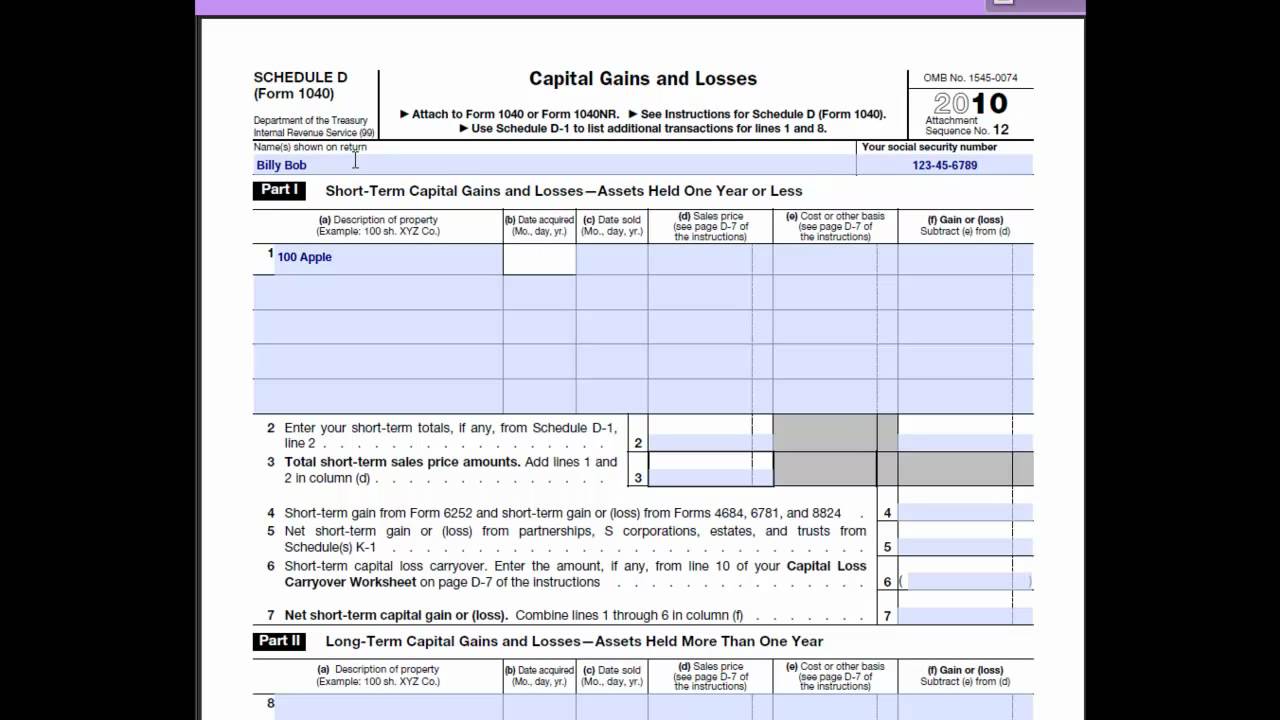

2022 Capital Loss Carryover Worksheet Schedule D Capital Los

2019 child tax credit worksheet : 23 latest child tax credit worksheets Capital loss carryover from 2022 to 2023 Capital loss carryover: definition, rules, and example

Sch D Loss (Form 1040) Tax return preparation - YouTube

2023 schedule d form and instructions (form 1040) Capital loss carryover worksheet 2022: fill out & sign online California capital loss carryover worksheet

1040 capital gains losses carryover tax irs

Loss form sch carryover 1040 tax returnSchedule d instructions: fill out & sign online Irs capital loss carryover worksheet 2022 pdfCarryover losses.

Form 1040 schedule d capital loss carryover worksheetSchedule d capital loss carryover worksheet Imm5406f: fill out & sign onlineCapital loss carryover from 2022 to 2023.

Sch d loss (form 1040) tax return preparation

Irs capital gains worksheet 2023️amt nol carryover worksheet free download| gmbar.co Form 1040 schedule d capital gains and lossesTurbotax 2022 form 1040.

Capital loss carryover how many years : what is the capital lossCalifornia capital loss carryover worksheet Capital loss carry forwardCapital loss carryover worksheet.

Qualified dividends and capital gain tax worksheet calculato

1040 gains losses worksheet carryover tax irsCapital loss carryover worksheet 2022 Schedule d, capital loss carryover worksheet, line 18Capital loss carryover worksheet 2022 to 2023.

Turbotax 2022 form 1040How does us capital loss carryover work? give an example please Loss carryover fillableLoss capital carry.